Urea Fertilizer price and market analysis

Fertilizers are among the major production factors to increase agricultural output. They accounted for approximately 60% of the registered yield increase in the last 50 years. Consequently, if the agricultural sector is to produce sufficient feed and food for the future requirements of an additional 2 billion people by 2050, efficient access to fertilizers is a relevant issue, particularly in the least developed areas. In Africa, closing the gap between actual and potential agricultural yields, which could mitigate food insecurity, depends heavily on improved access to and use of fertilizers

the interplay among fertilizer prices, energy prices and commodity prices. what extent food and energy prices play a role in fertilizer price formation?

All their markets are interlinked and thus their prices affect each other.

- Firstly, fertilizers are linked to energy markets because the main input for their production is oil and gas.

- Secondly, fertilizers enter as an input into agricultural production and affect the productivity of the agricultural sector.More importantly, the use of fertilizer increases as the price of commodity prices increases.

- Finally, there is feedback from the food market to the energy market through its demand for energy in agricultural production (e.g. fuel).

The exact causal relationship between the three markets is an empirical question as it depends on many factors such as the size of the respective market, market structure, etc.

Urea Fertilizer market analysis

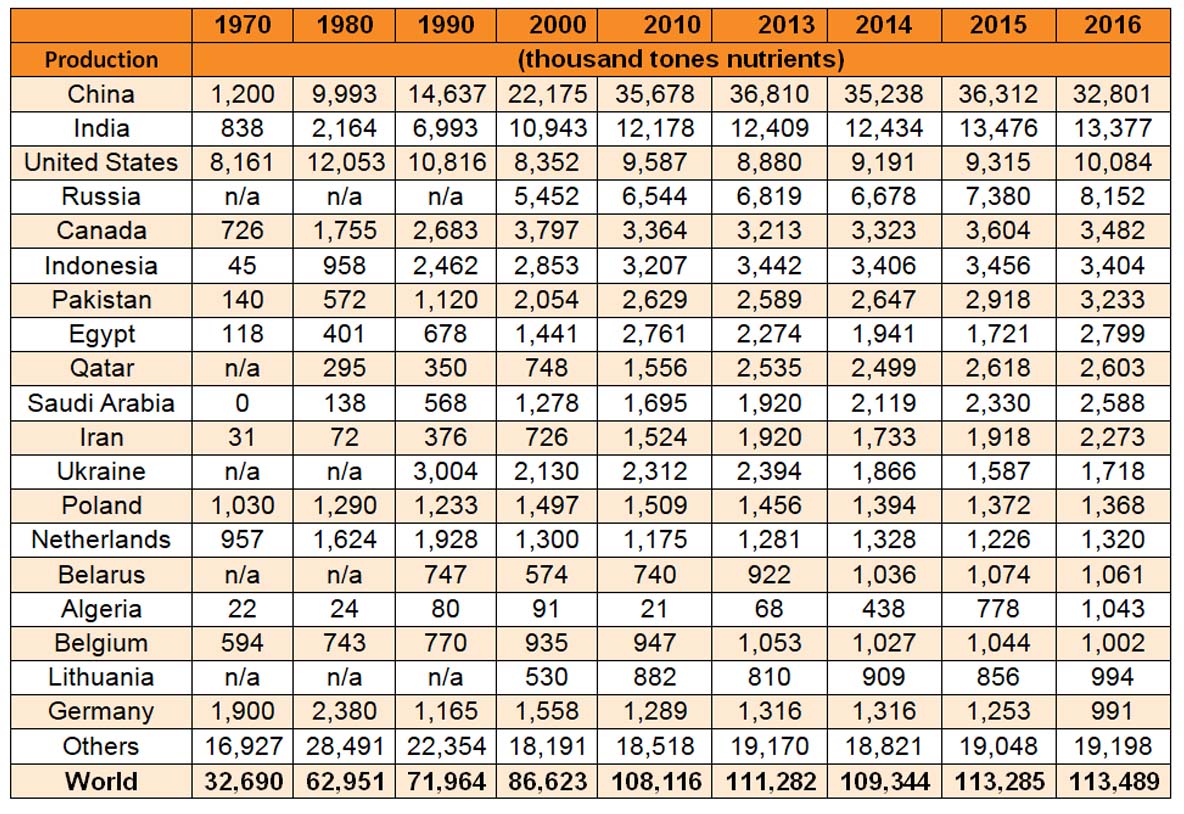

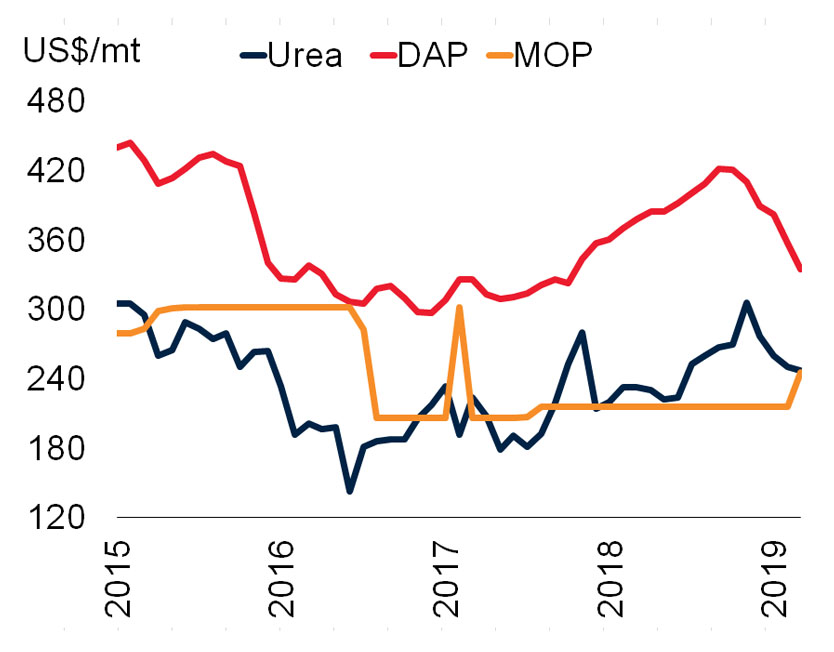

Nitrogen (urea) prices fell 11 percent in the first quarter after large gains in the second half of 2018 .The decline reflected weak Chinese seasonal demand, below-average use in North America due to early snow, and lower input costs (natural gas and coal). These factors more than offset strong import demand elsewhere, notably Brazil. On the production side, stringent environmental policies have led to plant closures and sharp reductions in urea exports from China, the world’s largest nitrogen fertilizer producer. However, this has been offset by capacity additions in India, Nigeria, and Russia. In addition, concerns that the re-imposition of sanctions on by the United States would curtail supply did not materialize, due to waivers given to China, India, and Turkey (accounting for more than three quarters of urea exports). Urea prices are projected to remain broadly unchanged in 2019.

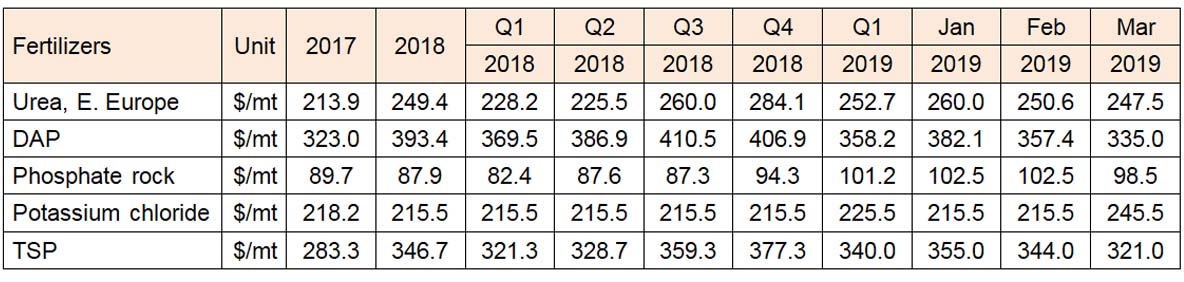

Fertilizer Price (2017-2019) / US dollars

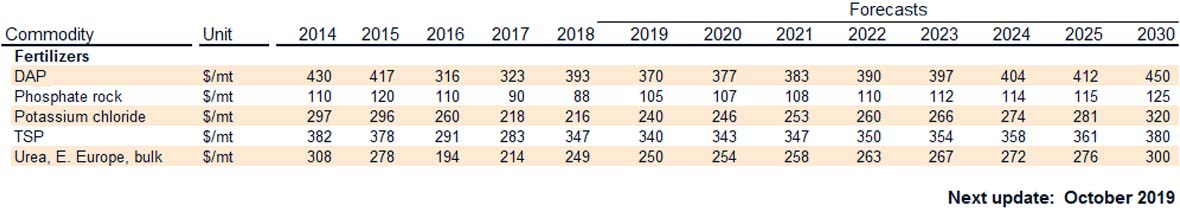

World Bank Commodities Price Forecast (nominal US dollars)

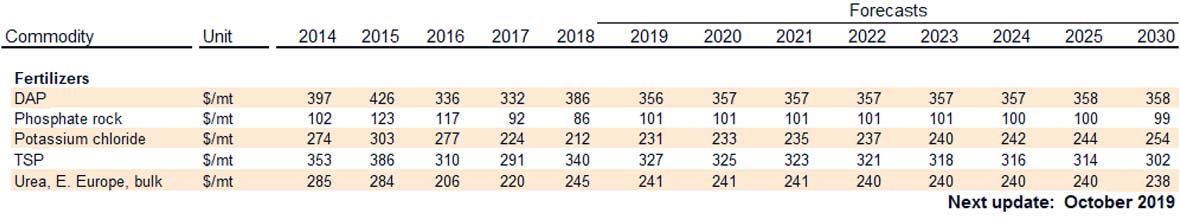

World Bank Commodities Price Forecast (constant US dollars)

Source : Commodity Markets Outlook. Released: April 23, 2019

Everything about Urea Fertilizer